You want to buy your first property but don’t have a contribution? Contrary to popular belief, it is quite possible to invest without being able to present capital in order to convince a bank. Chez Nestor, a specialist in furnished flatshares, will explain how to proceed!

Our advice to build a perfect file

Negotiating a loan can be complicated but not impossible since everything depends on your file. If you are, for example, a young worker, a bank is perfectly able to understand that you may not have had the opportunity to build up your savings yet. It is, therefore, necessary to plan the expenses of your daily life but also those related to your credit (interest, guarantees…). The difference between the charges you have to bear before and after the loan is called the ” charge jump “. You must be able to prove that you can handle it, so it is wise to plan the right amount of borrowing and not to be too greedy.

The biggest difficulty will be to reassure your bank or broker, who will give as much attention as possible to studying your file. However, you can gain credibility if you can prove that you have a stable professional situation, in particular by demonstrating that you are on permanent contract or a civil servant. Being part of a large group or a company that has been renowned or present for several years will also give your bank confidence.

To gain confidence, do not hesitate to complete your file with your latest pay slips and bank and savings statements. A fixed salary combined with a bank account without overdrafts or incidents inspires confidence.

Finally, presenting a signed sales agreement or a written sales agreement from the owner and possibly your rental project will be the essential element to prove that your project is more than thoughtful and that you have taken certain steps.

Compare the offers of different organizations

A well-known reflex for everyone is to consult only your own bank to apply for a loan. We imagine that this establishment knows us and that it will be easier to win. Don’t be fooled, because other banks could also trust you, sometimes even at much better rates! So take the time to consult several banks, and review their rates but also the guarantees in the contracts.

If you are not comfortable with this approach, you have the opportunity to contact a real estate broker like Pretto. Its role is to support you from the creation of the file until you obtain your credit. It will be able to provide you with expert advice and tell you the best way to complete your file according to your profile. It also acts as an intermediary between the banks and you: you no longer have to deal with the administrative procedures and agree on sometimes endless appointments with terms that are totally unknown to you!

The broker is also aware of the current rates and will know which institution to contact according to your project, in addition to benefiting from particularly attractive rates! He will also have the reflex to anticipate a flexible rate that takes into account the hazards of life such as weight loss, accident, disability…

From the banks’ point of view, it is particularly interesting to use a broker since he is able to bring them a new clientele, a good argument for offering advantageous rates. This last point is, therefore, an argument that can be particularly advantageous for you!

Learn more about assisted loans and different insurances!

The State promotes home ownership, as do local authorities, for example by offering loans at zero interest rates. They can be combined with the main loan, and therefore take the value of personal savings. This is particularly the case for the 0% Paris housing loan, which can be combined with the ZIL (Zero Interest Loan – PTZ in French ). You can also contact the municipalities to find out about any possible assistance.

To make your property purchase as secure as possible, it is important and mandatory to contract a loan insurance. Most banks will offer you a classic plan but take the time to review all the guarantees that are included. The purpose of insurance is to protect you if you are partially or totally unable to work, temporarily or permanently. Since 2010 in France, thanks to the Lagarde law, you are not obliged to take out this insurance with the bank that grants you the loan. You are therefore free to subscribe to it with the organization of your choice.

You should also know that the Hamon law, which exists since 2016, allows you to change your insurance contract during the first year of your loan at no cost! The perfect solution if you come across a more interesting offer depending on your situation!

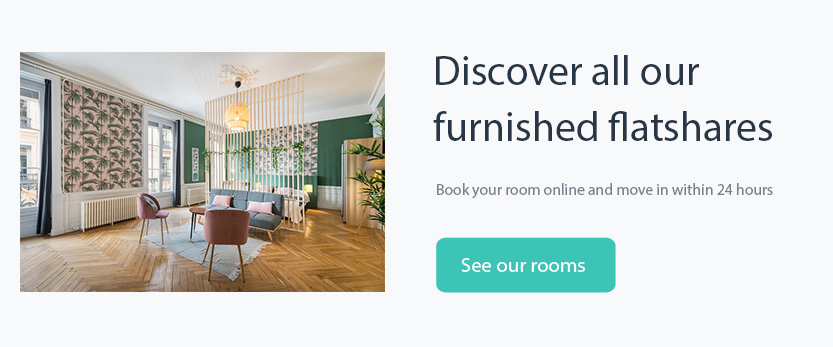

You are dreaming of one day buying your own property, but for the moment your budget does not allow you to do so and you are rather looking for a shared accommodation? Chez Nestor offers furnished and equipped rooms in the biggest cities of France and Spain!

Leave a Reply