You want to create a French bank account but you don’t know where you have to start ? Chez Nestor, expert in students and young workers accommodation, made you guide of the process you need to follow to open a bank account in France.

The opening of a French bank account

Before starting the process, you have to know to which kind of French bank account you have access. Here, two options are offered to you, they depend on the fact you’re resident or not.

#1 You have a residence proof and you stay in France longer than 3 months

If you want to stay in France longer than 3 months, you will be able to open a current account as “resident”. In most of the case, it’s free.

You will need the following documents to open your French bank account :

- your residence permit

- your passport

- a recent proof of address ( bills of electricity or gas, bills of telephone, rent receipt etc.). Your name and your address have to appear on this receipt. It will prove you’re really living in France.

#2 You don’t have any residence proof

If ever you don’t have a residence proof or a residence permit, no panic ! You will still be able to open a “non-resident” account. “Non resident” accounts have usually the same characteristics as the residents ones in terms of costs or services. The only one disadvantage of this type of account is that the bank doesn’t delivered credit card and doesn’t accept overdraft.

Without card, you will have to pass by an advisor to make your process (withdrawal, deposit etc.) to your bank.

How to choose you French bank?

Before making your choice, check to your bank from your country if it exists a partner bank in France. Indeed, you will be able to get pricing advantages and simplified process.

In any case, opt for the main french banks. Their vaste networks will allow you to have access to an adviser or a distributor at any time.

#1 The biggest French banks

Here are the 7 main french banks :

- BNP Paribas

- Société générale

- Crédit agricole

- Caisse d’Epargne

- Crédit Lyonnais

- Banque populaire

- Crédit Mutuel

#2 The “Banque Postale” option

La Poste also offers banking services. Thanks to a network of Poste offices all around France, this option will allow you to reach to your account in all french towns.

#3 Online banks

If you like to manage everything from your smartphone, open a French bank account in an online bank could be a good alternative. Besides giving more freedom to their users, online banks have advantageous prices.

However, careful ! Most of online banks as Boursorama banque or Fortuneo have terms of access very restrictive. Actually, you need to have a mensual income of 1500€ or a saving of 5000€ at the opening of the account.

The easiest solution for students is to open an account in Monabanq which doesn’t ask any payment terms or financial resources at the opening of the account.

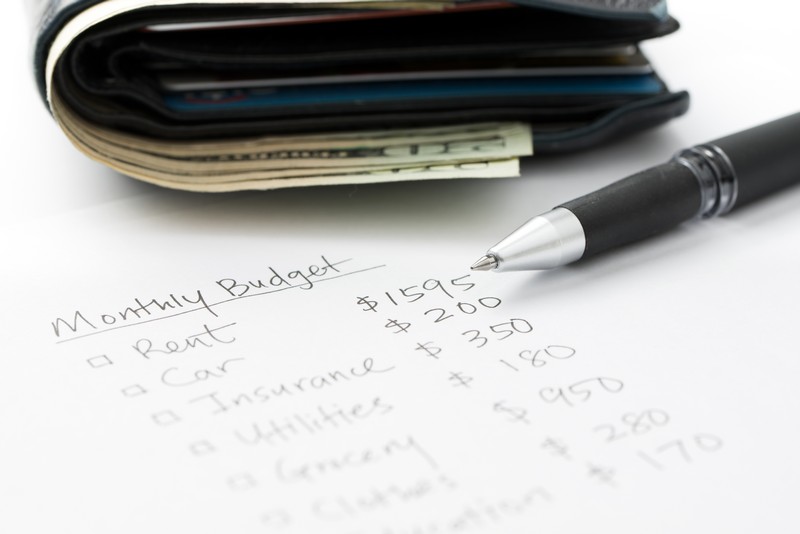

Terms and prices to open a French bank account

#1 Check your contract

Before finalizing your contract, have a check to terms and prices of the different banking operations. Generally, banks supply a pricing brochure which contains the different bank costs to know which one is the less expensive on a year. Think about verified and compared the following points to avoid bad surprises :

- Running account costs : They are costs you received for the simple management of your account. They are not linked at any service. Some banks charge it more than others, you will need to pay attention.

- Withdrawal outside the network : Some banks make paid you a surcharge if you withdraw money in another bank than its own distributors. Check the policy of each bank for this subject.

- Bank statements : Usually, they are sent each month at your home. Some banks make paid a surcharge for the consultation of your online accounts. Check the pricing brochure.

- Credit card and debit card prices : These prices change according to banks and the type of card. Compare offers of the different banks. Generally, cards arrive in 1 to 2 weeks after the account opening.

#2 Insurance

Banks are more and more abundant supplying insurance contracts. As the basic insurance, banks can offer you contracts concerning : some goods, some credits, some ways of payment, some person. The advantage of this option is to get only one representative for the management of your French bank account and your insurance contracts. As always, define your needs then compare offers before choosing.

Opening hours

Most of french banks are open from Monday to Friday from 9am to 6pm. However, careful ! Usually they are closed between 12am to 2pm.

In downtown, banks are often opened the Saturday morning from 9am to 1pm.

Are you looking for accommodation in France?

When moving to a new city, it is not always easy to find accommodation, especially if you are only staying for a few months. Chez Nestor, a specialist in shared accommodation, offers you furnished and fully equipped rooms in the heart of the largest French cities. For more information, visit our website!

Leave a Reply